Take me down to the Paradise papers

Tax avoidance in Europe

Source: European Commission

I believe that every child has their own musical hero. Mine was definitely Bono Vox. I was in the early stages of primary school education when U2 released their comeback album All that you can’t leave behind. It was well-received by critics, and featured the hit single Beautiful Day. The music video for this single featured the band in a pre 9/11 airport, giving people with an unfortunate past an optimistic message for the future. When I saw it on MTV for the first time, I really wanted to have their album. I had to beg my parents for months. With good grades in school and my birthday steadily approaching, I finally got my gift, and I was the happiest child on Earth. Many years later, I had an opportunity to watch U2 performing a concert in my hometown, and needless to say, it is something I will remember eternally.

However, nowadays my rock hero Bono Vox is in the media for completely non-musical reasons. Although U2 is preparing a new album, no one is talking about their new single but about the recently discovered Paradise Papers scandal, which unveiled controversial tax dealings of Bono and many other famous personalities. Bono, who would like to be remembered for his philanthropy as much as his music, stands accused of owning a stake in a Maltese company that bought a Lithuanian shopping mall, and apparently broke tax rules by using an unlawful accounting technique.

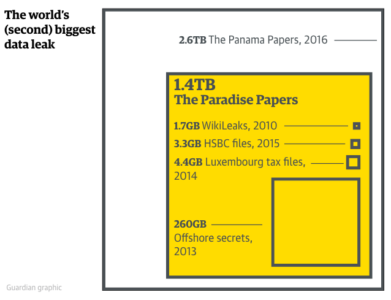

The Paradise Papers basically unveil ties of more than 120 world politicians from 50 countries with off-shore companies. The documents were leaked from the law firm Appleby from Bermuda and Asiaciti Trust from Singapore. They were obtained by the German newspaper Süddeutsche Zeitung, who shared it with the International Consortium of Investigative Journalism (ICIJ). More than 13.4 million confidential documents were leaked to the public. The documents contain tax secrets of the world’s richest, something that could be comparable to the last year’s scandal with the Panama Papers or the Luxemburg Leaks. However, it is claimed that most of the transactions do not include any illegal actions. Lack of ethic or embarrassment, that’s another thing.

The British media, most notably The Guardian, have understandably put their focus on data regarding Queen Elisabeth II, which shows that she has invested through the Duchy of Lancaster 10 million pounds to funds in the tax havens on the Caiman Islands and Bermuda. The Canadian press is furious after learning that Stephen Bronfman, the senior advisor to Prime Minister Justin Trudeau, has transferred millions of dollars to tax heavens. According to the Guardian, Bronfman inherited wealth through the company Seagram and played a key role in helping Trudeau’s rise to power by collecting donations.

The press corps in the US are also more than interested in the whole case, as it shows some wider implications on their political and social system. Major companies like Apple, Nike and Uber stand accused of tax avoidance, but a special focus has been put on two cases, one involving social media giants Twitter and Facebook, and the other involving US Commerce Secretary Wilbur Ross. The New York Times wrote that the Paradise Papers reveal that Russian companies with Kremlin ties invested hundreds of millions of dollars in Twitter and Facebook. One year after the shocking victory of Donald Trump and the infamous role of social media in his victory, these accusations should be well-approached. Regarding Wilbur Ross, he has a 31 percent stake in a maritime transport company Navigator Holdings, achieved through offshore investments. The company has close ties to Putin through the Russian energy giant Sibur.

The European Union as such is planning to set up a blacklist of worldwide tax havens. The Member States have been planning to reach an agreement on the topic for months, but the process is not expected to be finished anytime soon. Commissioner Pierre Moscovici said that he is horrified but not surprised with the new revelations, while the EU Parliament and the Council are in an eternal struggle over matters of privacy and identity of the company owners, or in other words, over different interests. While OECD is warning of the damage, NGOs such as Transparency International are furious, and called on the EU Member States to change the outdated legislation which protects privacy of accounts in tax heavens. To put it in simple terms, more tax avoidance means less money for education, health and the underprivileged.

Tax avoidance is costing the world’s most disadvantaged countries more than $100 billion every year, as profits made in poorer countries are shifted to wealthier tax havens. Some years ago I had a scholarship at the University of Oslo, where I studied the Norwegian political system. It was fascinating for me that one of the richest countries in the world has such high taxes. But then I understood that these taxes were financing the welfare state, and their free healthcare and education. Despite certain criticisms emerging throughout the years, I very well remember an interview with some young Norwegian entrepreneurs in their local newspaper. They said that they were happy to pay their taxes, because the Norwegian state educated them for free and provided them the security throughout the years which gave them the opportunity to develop their skills. Unfortunately, not all share their ethical views on the society. That’s where regulation should come in.

Source: ICIJ